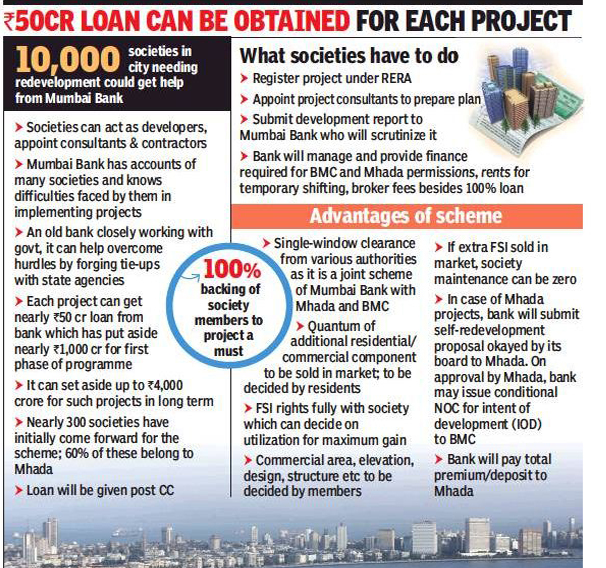

While, Mumbai City is already witnessing slump in the Real Estate Sector with lakhs of unsold inventory in terms of 2-3 BHK flats, the recent joint Scheme by MDCC, MHADA and BMC to fund the existing society for self-redevelopment can lead to further surplus in the supply market.

New Financing Policy for Co-Op Societies in Mumbai Promoting Self- Redevelopment

Projects of self-redevelopments are being facilitated with a Single window system of clearance as this is a joint scheme of Mumbai District Bank, Mahada and BMC. This essentially involves least of office procedures and fastest processing of approvals and NOCs.

An individual society can be financed up to Rs. 50 cr. loan amount which is pretty generous amount of money for societies of small and mid size still having potential FSI available in view of new DP-2034. By developing extra built up area on account of extended limit of FSI, the societies can make huge profit out of sale. Many are mulling over to use the profit for a corpus to ensure maintenance of society free for an extended period of time. This apart, the societies can use the profit booked for various other purposes in the larger interest of the society. On account of new arrangement in place the existing members will be availing more of carpet area along with better construction quality as the construction will go under direct monitoring of the society.

On chief minister Devendra Fadnavis’s instructions, MHADA has set up a special cell to facilitate proposals. And, clearances are being facilitated in as less as 7 days time window. As much as Rs.777 cr. has been pre-sanctioned by MDCC and the govt, based on inputs from potential beneficiaries is promoting formation of a consortium of banks to raise the fund available under this scheme to the tune of Rs. 5000cr.

Responses from the societies with regard to self-redevelopment scheme are very encouraging and the benefit is being viewed to cover 10,000 societies in the Mumbai City. As per preliminary work out, the banks will be able to recover their loan even if a flat with eligible sale rate of Rs, 35000/ sqft. sells in the market at a rate of Rs 24000/ sqft. The estimation by the banks are indicative of the fact that, that traditional builders who aim to sale a constructed unit at the rate of Rs. 35000/sqft. will face a steep competition with the sale offered by these redeveloped societies.

The re-development scheme offered by state bodies is being seen as fast-catching trend of housing societies underway for redevelopment. Mumbai Mirror puts everything in detail here:

These scenario of potentially flooding the supply is only going to mar the success of our model of BUILT UP SALE self sustainable model.

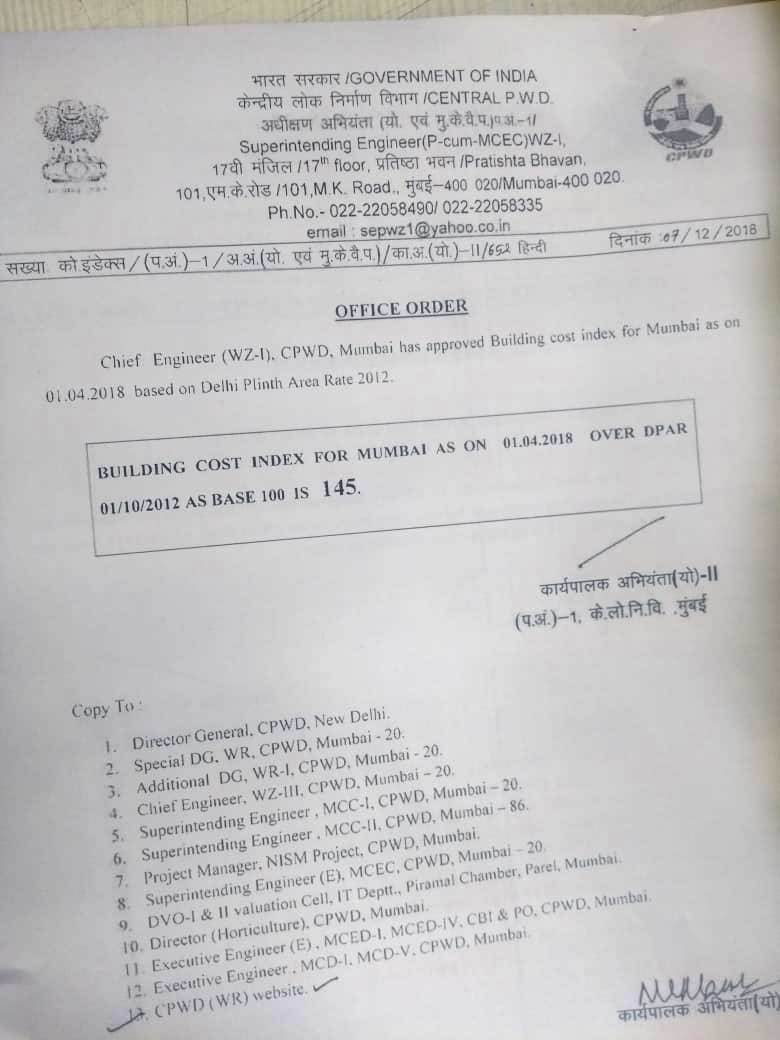

PAR indexes Have Been Revised to 145 From Earlier 132

Our earlier mega plan of 10 Lakh sq mtr. was already facing the viability gap on account on non-waiver of premium due to state amounting Rs 2200 Cr. (Which was eventually dropped after written communication from state on non-waiver).

Although, in the meeting with RS on 26.12.2018 the ARCOP professionals worked out the premium payable down to 1500 cr.; in view of new PAR index of 145 the viability gap is only going to increase.

In view of PAR index revised the project cost is going to rise roughly in a ratio of 145/132. So, as a ballpark figure a Rs 10,000cr project would go up by 11,000 cr. plus when other taxes and charges are accounted for.

Development of meeting with new RS on 26.12.2018 was aimed at working out afresh the mega plan (10 Lakh Sqft with 4/5 FSI) to level up the viability gap. Meaning, a standard layout plan with early gap of 1500cr, will require filling the gap of Rs. 2500 (1500+ 1000) cr.

So, the proposed reworking of initial mega plan with nullified viability Gap and the subsequent blueprint to be received may strip off several attributes of construction that can bring down the overall quality of habitation.

The Copy of CPWD Office Order Effecting New PAR Index

***************************************************************************

1* MDCC ( Mumbai District Central Co-operative Bank Ltd.) is a central financing agency of all affiliated co-operative societies in Mumbai district, which is popularly known as “MUMBAI BANK” and is registered under MCS Act in the year 1974 and started its functioning on 12th Feb.1975. Since, there is no agriculture production in this District, MUMBAI BANK is catering to the financial needs of non agricultural co-operative societies such as Urban co-op. banks,